Real Estate News That Matters.

Stay informed on the Real Estate matters

The Real Estate Buzz Network. 🐝

Real estate news that matters

The Thornhill Woods Haunted House will be transforming their entire home into a haunted house to celebrate Halloween while collecting donations for the Sick Kids Foundation. The family brings their scariest monsters, witches, ghosts and more, turning their front yard into a massive cemetery. For three nights only from Oct 29 to Oct 31, stop by 1 Krisbury Ave and experience the haunted corn maze with themed rooms that are sure to get a scream or two out of even your most stoic family members. For the faint of heart, opt to watch the fun (and fear) unfold from the front yard, where you'll be greeted by spin-chilling music and ghostly ambient lighting. Happy Haunting! For more info visit: www.thornhillwoodshauntedhouse.com Article by North Toronto Magazine October 2021 Volume 28 Issue 3

RIOS (real estate industry operating system) is a data platform that aims to eliminate the holdups around approvals and communication in the home-building industry — problems co-founder Joe Vaccaro says he witnessed first-hand as former CEO of the Ontario Home Builders’ Association. “Government efficiency is a wonderful goal, but ultimately in the industry this is our opportunity now,” Vaccaro said. “We’re looking to build a platform that gets you the compliance and approval and, ultimately, gets the consumer into their home faster and cheaper than what the system provides today.” Vaccaro cited assignment sales — the process where a pre-construction condo buyer resells that property — as one area that would benefit from the RIOS technology. A largely paper-driven process, the transaction that involves the seller, builder and buyer could be hastened to 10 days from 30 days, for example, he said. “The expectation is that building the data highway helps consumers when they get to the point of signing that purchase and sale agreement — that the process in front of them is so efficient that they’re not going to have to worry about delays in paperwork, delays in regulation, delays in compliance. “Ideally the data flow is so smooth and easy they get their home delivered on time with no issues,” Vaccaro said. RIOS is partnering with Teranet, the company that owns and operates Ontario’s property search and registration system. It will identify and address a variety of problems in housing and commercial real estate, said George Carras, founder and CEO of real estate innovation company R-LABS, which announced the new enterprise on Tuesday. The housing supply crisis is the catalyst for revolutionizing the way the development industry does business, gathering data in one system that tracks a project from design, approvals and sales, he said. “When history happens no one rings the bell and says, ‘Today is the day things change.’ Today is that day,” Carras said. He called the RIOS platform “an excellent tool to help drive efficiencies” in a system “that is cumbersome and inefficient.” Making development more efficient puts more supply online faster, and it is supply — or lack of it — that is driving Ontario’s housing affordability challenge, Carras said. Also named as a co-founder of RIOS is Antoni Wisniowski, a former president of the Municipal Property Assessment Corporation (MPAC), which assesses real estate in Ontario. Article by PENELOPE GRAHAM for ZOOCASA

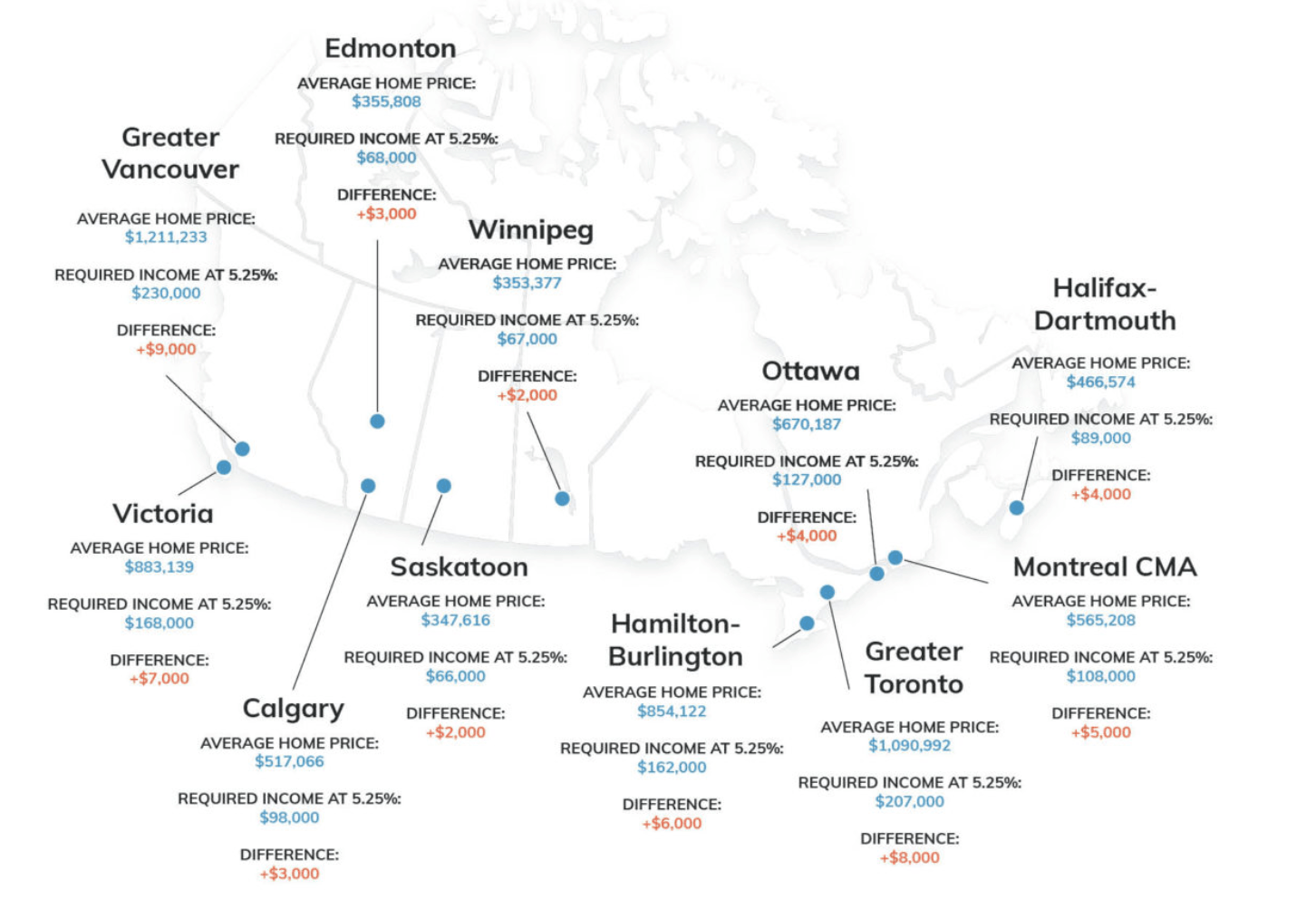

As of today, it’ll be a bit tougher for new and renewing mortgage borrowers to qualify for their home loan. A higher threshold for the “stress test” has come into effect, requiring borrowers to prove they can carry their mortgage costs at an interest rate of 5.25% or their contract rate plus 2%, whichever is higher. This is a slight increase from the previous threshold of 4.79%. The stricter criteria applies to both insured mortgage borrowers (those who make a down payment smaller than 20% on their home purchase) and uninsured borrowers, who put down 20% or more. What Does the Stress Test Do? Simply put, in order to pass the stress test, borrowers must have healthy-enough incomes and debt servicing ratios to indicate they could pay their mortgage payments at the higher interest rate, regardless of the rate they actually get from their lender. For context, current fixed and variable mortgage rates are as low as 1.7% – 2% for a five-year term, so the stress test will tack on at a minimum 3% or higher. This translates to borrowers qualifying for a smaller mortgage amount. How Will the Stress Test Impact Home Buyers? However, as borrowers have been stress tested since 2018, the impact of this latest change will be fairly minimal. According to analysis conducted by Zoocasa, a buyer looking to purchase the average-priced home in their city would face a dip in affordability of about 3.8%, with between $14,000 – $47,000 shaved off the amount they’d qualify for. To make up for this difference, the study determined borrowers would need to supplement their incomes between $2,000 – $9,000 in order to qualify for the same size mortgage under the new stress test, depending on the city they’re purchasing in. To determine these differences, Zoocasa calculated the income required to qualify for a mortgage large enough to purchase the average-priced home in 11 cities across Canada at both a mortgage rate of 4.79%, and then at 5.25%. It was assumed home buyers had no additional debt, were making a 20% down payment, and were amortizing their mortgage over 30 years. Borrowers would see the largest dollar amount slashed from their qualification in Greater Vancouver, where the average home price was $1,211,223 in April; they’d receive $47,170 less on their mortgage, and would need to supplement their income by $9,000 to qualify for the same sized mortgage post stress test. Next was Greater Toronto, where qualification would be reduced by $42,475 on the average home price of $1,090,992, resulting in a requirement of $8,000 in additional income. The buyers least impacted by the stress test were found in Saskatoon and Winnipeg, where average home prices are $347,616 and $353,377, respectively. Qualification amounts in each would be reduced by $13,661 and $13,875, requiring an income increase of $2,000 to qualify for the same size mortgage. Check out the infographic below to see how the stress test impacts average home buyers across Canada: Why Is the Stress Test Being Increased? The tougher stress test is part of efforts by both the federal banking regulator (OSFI) and Department of Finance to reduce the amount of risky mortgage debt currently held by Canadians as a result of the pandemic home buying boom. Part of the issue is the aforementioned historically low mortgage rates; interest rates have been kept at record lows over the past year by the Bank of Canada to protect the economy and keep liquidity in the market. However that’s made it cheaper to get a mortgage than ever before; combined with lockdown buyer psychology and pent-up savings, buyers have been motivated to get into the housing market at an unprecedented rate. That has pushed home prices to stratospheric new heights in markets across Canada, as buyers working and schooling from home have sought properties with more space. The ability to work from home has also decoupled them from big city centres and shifted demand to smaller suburban and rural markets, known for their comparable affordability. However, supply has struggled to keep up with demand. Bidding wars and homes selling for far over their listing price has become the norm, even in secondary markets where these dynamics were previously rare. The Canadian Real Estate Association reports the average home price soared by 41.9% in April to $696,000, with average home prices easily topping the million-mark in the most in-demand markets. As a result, more home buyers have had to bid higher than they otherwise would have to win their homes, and have taken on larger mortgages. The concern is that when interest rates do inevitably rise, these newly-minted homeowners will struggle to keep up with their mortgage debt. In fact, overly-leveraged households pose one of the largest risks to the economy, according to the Bank of Canada. In their most recent Financial Systems Review, the central bank states, “The biggest domestic vulnerabilities are those linked to imbalances in the housing market and high household indebtedness. These are not new, but they have intensified because of the unusual circumstances caused by the pandemic.” The BoC adds that buyer expectations have become “extrapolative”, meaning they believe prices will keep rising, fueling their fear of missing out, and hedging on rapidly growing equity in order to afford homes outside of their budgets. This has led to higher levels of mortgage debt, with more borrowers taking on a higher loan-to-income ratio, leaving them potentially financially exposed. The fear is that should an unexpected financial event shock the economy, it could cause a chain reaction of homeowners defaulting on their mortgages. “It is important to understand that the recent rapid increases in home prices are not normal. Even without a shock, some of the factors that caused prices to rise fast could reverse later, and that could leave some households with less equity in their homes,” states the BoC. It remains to be seen whether additional methods to cool the housing market will be rolled out by policy makers as the economy recovers from the pandemic. In the meantime, buyers will need to absorb this new affordability requirement when budgeting for their home purchase. METHODOLOGY: Average, not seasonally adjusted home prices for April 2021 were sourced from the Canadian Real Estate Association. (CREA) Calculations assumed a home purchase down payment of 20%, 30-year amortization, and no additional debt, no condo fees, $125 heating costs, and $331 property tax. Calculations were made using ratehub.ca/affordability-calculator. Article by PENELOPE GRAHAM for ZOOCASA

Canadians can now receive up to $5K to make their homes more energy-efficient. Yesterday, the federal government launched the Canada Greener Homes Grant program, an initiative that offers Canadians grants of up to $5K to pay for energy-saving revamps in the home. This means things like heater upgrades, the addition of solar panels, and replacing old windows and doors for greener alternatives. In addition to the dollars allocated to retrofitting their homes, homeowners will also receive up to $600 to help with the cost of home energy assessments. In order to qualify, the home must be the owner’s primary address. New homes are not eligible for the grant; the residence must be at least six months old (from time of the first resident) and eligible for an EnerGuide evaluation. Solar energy system with photovoltaic solar cell panels on house roof (3D Rendering) Those interested are able to apply online beginning today. The process begins with an energy assessment by a certified advisor, who will visit the applicant’s home to decide which types of planet-friendly upgrades would qualify for the grant. If all gets the green light, a licensed contractor is hired to make the upgrades. Then – upon completion of the final product – the homeowner will be reimbursed. The grants will be retroactive to December 1, 2020. The pricey but positive and proactive move will cost $2.6M over seven years and help some 700K homeowners live more planet-friendly everyday lives. In addition to the environmental benefits, the program will recruit up to 2,000 new energy advisor jobs across the country with a strong emphasis on diversity and inclusion. So, if you can part with the cash in the meantime (this is key), it may be something to consider. Article by: Erin Nicole Davis

The future cityscape of Toronto. Torontonians may have been locked down over the past year during the pandemic, but construction and development kept going. Now, with the city on course to slowly emerge, we’re taking a look at some of the most interesting buildings and developments slated to go up in the next few years that will transform how we experience the cityscape – for better or for worse. From developments billed as sustainable to future skyline icons and hyped neighbourhood game-changers, we looked at projects that will alter the city in environmental and aesthetic ways, impact the city’s heritage buildings and attempt to address the city’s affordable housing crisis. The One Who is involved: Foster + Partners, Core Architects Location: 1 Bloor West Categories: Skyline How it will change the city: The condominium tower will become a skyline icon – and the tallest building in Canada. The One, an 80-storey (306 metres) condominium combined with retail use, is set to become the tallest building in Canada, and the second-tallest man-made structure in the country after the CN Tower. Located at the heart of Yonge and Bloor, the team behind this skyscraper has plans to make it the first vertical retail icon of its kind in Toronto, and create a second, more northern visual focal point in the skyline. Giles Robinson, an architect and senior partner at Foster + Partners, says the multi-level retail components of the buildings will be distinctly sectioned off from the rental units above, reflecting the unique design of the building. Tall buildings continue to be a point of contention in the city of Toronto; while considered necessary to add densification, some residents have advocated for more mid-rise buildings out of concern for the aesthetic and shadowing that comes with towers. Cheryll Case, founder and principal urban planner of CP Planning, says that if the city wants to achieve income and housing equality, there would be more of an investment in spreading housing density across neighbourhoods instead of backing construction of tall buildings in the core. “Whatever benefits come from that individual building, there is a loss in capacity for areas outside the core to develop as walkable neighbourhoods, therefore increasing car dependency and transit inefficiency,” she says. St. Lawrence Market North Who is involved: City of Toronto, Rogers Stirk Harbour + Partners, Adamson Associates Architects Location: 92 Front East Categories: History, Heritage How it will change the city: Bringing back the historical connection between St. Lawrence Hall and the iconic market. The development of the much-anticipated St. Lawrence Market North building has been over 10 years in the making. There have been multiple iterations of this building so far since the 1800s, acting as a sister building to the South Market and St. Lawrence Hall. Ivan Harbour, architect and senior partner at Rogers Stirk Harbour + Partners, says the project will attempt to bring the scale of the South Market back to the North Market. “The main aspect to the project is to find a way to create a building which is very human and engages with the area of the neighborhood around it,” he says. “This will help further regenerate and bring life to this part of town.” The development will combine courtrooms, offices and a large market in the open hall that will continue to operate as a covered, outdoor marketplace that can be adjusted to the seasons. A parking lot will also be constructed underground. Harbour says a standout element of the design is the connection between the two markets through St. Lawrence Hall. “In the old building, there was no connection, so hopefully again in the future, that sort of overlapping of activities through the Hall and into the new North market will expand beyond the boundaries of what used to be there,” he says. The site has operated as a makeshift open market for years as the development has been delayed, but once the construction of this building is done, the St. Lawrence district will be open for business in all its former glory once again. The Arbour Who is involved: George Brown College, Moriyama & Teshima, Acton Ostry Architects Location: 185 Queens Quay East Categories: Environment, Skyline How it will change the city: One of Toronto’s first large span mass wood structures will also make a mark on the skyline. The Arbour is an environmental and architectural first in Toronto and a groundbreaking development worldwide for large span mass wood structures. The 10-storey building will be a research hub at George Brown College and a community space for the entire neighbourhood. Thanks to its height and its mass-timber design, the waterfront building will be a new icon along the Toronto skyline. The team of architects behind the design plan on incorporating solar chimney systems to capture and harness light and air for natural ventilation and ground-source geothermal energy for heating and cooling, making it Ontario’s first mass-timber, low-carbon institutional building. Union Park Development Who is involved: Pelli Clarke Pelli Architects, Adamson Associates Architects Location: 211 Front West Categories: History, Skyline How it will change the city: Changing the look and feel of Toronto’s most well-known buildings. This four-acre mixed-use development will alter one of the city’s most well-known locations as we know it. The development is situated adjacent to the CN Tower and Rogers Centre, and will create 800 new residential units, including family units. The development also incorporates a three-acre urban park over the Union Station rail corridor, bringing green space into the downtown core. Office units and retail space will make this a true multi-use development, including a daycare, public art and a giant glass winter garden. The residential additions to this area will densify the area further and change the previously entertainment-heavy focus of the downtown core into its own contained neighbourhood. The iconic CN Tower and its accompanying buildings will be forever changed by this development, with three of the towers included in the development designed to peek out from behind the Rogers Centre and sit side by side alongside the CN Tower, but the hope is to provide some residential densification for the already-packed area. Moss Park redevelopment Who is involved: City of Toronto, the 519 Location: 150 Sherbourne and surrounding area Categories: Community How it will change the city: A controversial city project that will change the layout of one of Toronto’s most underserved communities The Moss Park development has been a point of contention among residents and city officials. The area is home to lower-income people and a large unhoused population, including a homeless encampment. While the city works to move people into temporary shelters, the officials have devoted efforts to other “revitalization” plans, which has seen an influx of wealthier residents moving into the downtown east. Residents and housing advocates have worried the proposed mixed-use Moss Park redevelopment will lead to gentrification. The city maintains the goal is to “create safe and accessible spaces for all members of the community” and, due to the high proportion of residents living in apartments, “provide the critical indoor recreation and outdoor space to serve both the existing and growing community.” Talks of redevelopment of the Moss Park neighbourhood started back in 2015 between the city, the 519 Community Centre and an anonymous donor. However, after four years the original plan was scrapped due to feasibility concerns. The city is now working on a new redevelopment plan, with a tentative completion date in 2026. The plan would design and construct a new John Innes Community Centre, along with “revitalizing” Moss Park itself, according to a statement from the city. The redevelopment is supposed to include a children’s playground and splash pad, a community garden, an open-use lawn and more. The city is also working with Metrolinx on the construction of the Ontario Line, which would include Moss Park Station on the site of the redevelopment. Block 8 West Don Lands Who is involved: COBE Architects, architects—Alliance Location: 125 Mill Categories: History, Heritage, Affordable Housing How it will change the city: Offering affordable housing options in one of the city’s remaining heritage districts Block 8 is part of a larger revitalization project in the entire West Don Lands area, some of which has been a source of controversy for residents nearby. Block 8 is the site of a former industrial area, near the Distillery District, and the mixed-use development will be primarily turned into rental units along with some retail space. Project director Thomas Krarup from COBE says the team took design inspiration from the surrounding neighbourhoods. “What we tried to do was to have this series of stacked buildings, where we tried to make the layering of podiums, and took our cues from the warehouse topology from the adjacent Distillery District,” he says. “Then for the mid-rise component that helps form a street wall, that takes its cues from the Canary District.” Krarup says that instead of creating a historic reinterpretation of the red-brick warehouses in the area, they did a contemporary interpretation. Of the 461 rental units, 30 per cent are designated affordable, which Krarup says are distributed evenly throughout all three buildings. The project is an example of a private development that includes affordable housing. Sean Meagher, coordinator of the Housing Issues Network, says that while the inclusion of a small number of affordable units in these projects is an “inescapable approach” to increase the city’s affordable housing supply, he says more diverse approaches are needed. “An equally necessary component to addressing the housing crisis is governments, including municipal governments, using their own revenues to build affordable housing, and invest in the building of affordable housing as well,” he says. “Private developers aren’t going to build deeply affordable supportive housing, for example, because there’s no market mechanism that makes that work economically.” Meagher adds the city is currently working on an inclusionary zoning bylaw, which would make it mandatory to dedicate a specific percentage of units in a development to affordable housing. He says that will be an important step, because currently, without any regulations, the city spends a fairly large amount of money in terms of subsidies and tax breaks to deliver those affordable housing units within private developments. “In fact, we spend on the units that are provided by the private market about twice as much as we spend for every year of affordability we get on units in the not-for-profit sector,” he says. One Delisle Who is involved: Studio Gang Architects, WZMH Architects Location: 1 Delisle (St. Clair) Categories: Environment, Skyline How it will change the city: Creating a new green-focused model for future residential buildings. Studio Gang is designing the unique structure of this 47-storey condo building, which is billed as a sustainability first for the city. The design team created eight-storey elements that interlock up the building. The balconies are designed to lean outwards, helping with sun-shading and wind protection. The design maximizes sun exposure while minimizing shadows, along with creating protected green space included on many of the balconies. One Delisle could set a precedent for the future of density-solving buildings if this style of “sustainable” balconies becomes the new normal for condos. Due to the angling of the design, the building can house a more diverse range of unit layouts and differing floor plans, offering a variety of options for residents in the St. Clair neighbourhood. One Delisle meets Tier 1 of the Toronto Green Standard, a set of sustainability requirements for new private and city-owned developments proposed after 2018. Ultimately, environmental sustainability will have to go further than just meeting building standards. “Inequality is not environmentally sustainable,” says Case. “This is kind of a greenwashing issue, because if [companies] really wanted to support environmental sustainability, they would be investing more in housing affordability and dispersal of density.” Port Lands projects Who is involved: Waterfront Toronto, City of Toronto, Grimshaw Architects Location: Port Lands and waterfront region Categories: Environment How it will change the city: Opening up acres of additional land and an entirely new island This elaborate waterfront project will change the city’s physical landscape by moving the mouth of the Don River 500 metres south, opening up acres of land for development and creating another entire island, the soon-to-be Villiers Island. Chief planning and design officer Chris Glaisek says the Port Lands have long been considered the future for city expansion, not only because the area is large and underutilized, but it has waterfront access and is close to downtown. Part of the development includes installing four large bridges that will provide transportation to and from the newly constructed island and around the developed area, including vehicle use, cycling, light rail transit and streetcars. Glaisek says that the newly exposed land that will be created through this development has the potential to become the first climate-positive neighbourhood in Canada. The area is set to be developed for a mixed-use community, including residences, an extensive park system and recreational facilities. Spadina Sussex Residence Who is involved: City of Toronto, University of Toronto, Diamond-Schmitt Architects, Harbord Village Residents’ Association Location: 698 Spadina Categories: Environment How it will change the city: Doubling the amount of green space in a neighbourhood after resident intervention. When Nick Provart, a Harbord Village resident, heard about the plans for this University of Toronto residence back in 2016, he realized green space wasn’t part of the plan. So he started a petition as an independent private citizen to get the university to provide green space through the development. An application for rezoning was submitted by the university, which the Harbord Village Residents’ Association and the city both opposed. The matter then went to the Ontario Municipal Board, and part of the outcome of the negotiated settlement included added green space for community use. Provart has also been involved in the construction of the sister site, 666 Spadina, which will become a small city park after development. “Those two green spaces are actually doubling our village’s available green space, so it’s quite big,” he says. Case says green space should be a key component for any development. “It’s very important to be adding park space and ample space for the growth of mature trees,” she says. “The green space should include enough space to, for example, have a pickup soccer game or do some community gardening. There needs to be space for different types of uses.” She believes consulting with community members and community groups will be essential to future development. “We need to invest in groups like those because they are well educated on planning, and they have a practice of maintaining deep and authentic relationships with those who are marginalized and developing social ties between those communities and the people who are making decisions and policy,” she says. Mirvish Village (Honest Ed’s redevelopment) Who is involved: City of Toronto, federal government, Mirvish Village BIA, neighbouring resident associations, Henriquez Partners Architects and Diamond Schmitt Architects Location: 581 Bloor West Categories: Affordable Housing, History, Heritage How it will change the city: A controversial affordable housing and heritage development that is replacing an old city icon. Many residents were sad to see discount store Honest Ed’s go in 2017, and years of work and community consultation went into the planning of the current development, which will include heritage elements, retail, residential, green space and affordable housing. Paul MacLean, a member of the Palmerston Area Residents Association who has been heavily involved in the community discussions around the development, says there have been a few major challenges and roadblocks for all stakeholders to come to an agreement about the site’s future. He says transit accessibility and traffic, green space, building height, heritage preservation and affordable housing were all points he and other residents had to really advocate for. “Preserving the houses on Markham Street was important to residents, and because of the support of the City Heritage department, we were able to significantly alter the original proposal [by developer Westbank Corp]. Heritage buildings along both Markham and Bathurst have now been preserved,” MacLean says. “This was a key value for residents, even though retaining heritage meant that the overall scale of the original development proposal had to be cut back.” Meagher says Mirvish Village is a prime example of why the government investing in affordable housing through private developments can result in fewer units that are less affordable. “The federal government provided a lot of incentive to get a fairly large number of units that are only affordable for a pretty short period of time, and they’re not that affordable,” he says. “When you look at the difference between the market rents and what the public sector got for that amount of money, it’s not a particularly terrific deal. One of the tasks of the city and of all levels of government is to make sure that we get a really good deal for the taxpayer.” The federal government committed $200 million to the site in 2020 for affordable units to be built. The development will now dedicate 30 per cent of rental units to affordable housing. The ORCA Project Who is involved: Moshe Safdie, PWP Landscape Architecture, Sweeney&Co Architects, City of Toronto Location: 433 Front West Category: Skyline How it will change the city: The most complex construction would create a skybridge fortress. On May 12, the Local Planning Appeal Tribunal (LPAT) appeared to rule permanently against the long-standing Rail Deck Park project that Mayor John Tory has been aiming for since 2016 in favour of the ORCA Project (which stands for Over Rail Corridor Area). Rail Deck Park would have transformed the 21-acre space above a central rail corridor into a massive park, covering Bathurst to Blue Jays Way West along Front. Now, the proposed $5 billion ORCA Project, a private developer’s plan to turn the space above the rail corridor into a sky community, will become the most complex construction in the history of Canada – that is, if it actually gets built. The development would include six residential units, one building for offices and a large multi-level retail space. Many of the buildings would be connected by “sky bridges,” and a space for public use would be included as well – metres above the street level, mostly accessible by stairs and elevators. During the tribunal, city planners argued that a private development was the wrong choice when there’s such a major need for public green space, and urban planning critics have condemned the “sky bridge urbanism” of this project for creating an inaccessible, fortress-like community rather than a true neighbourhood. While Tory has stated that city staff are “reviewing” the decision, with the approval from the LPAT, Toronto may be home to a neighbourhood in the sky in just a few years. Article by: By Julia Mastroianni for Now Magazine

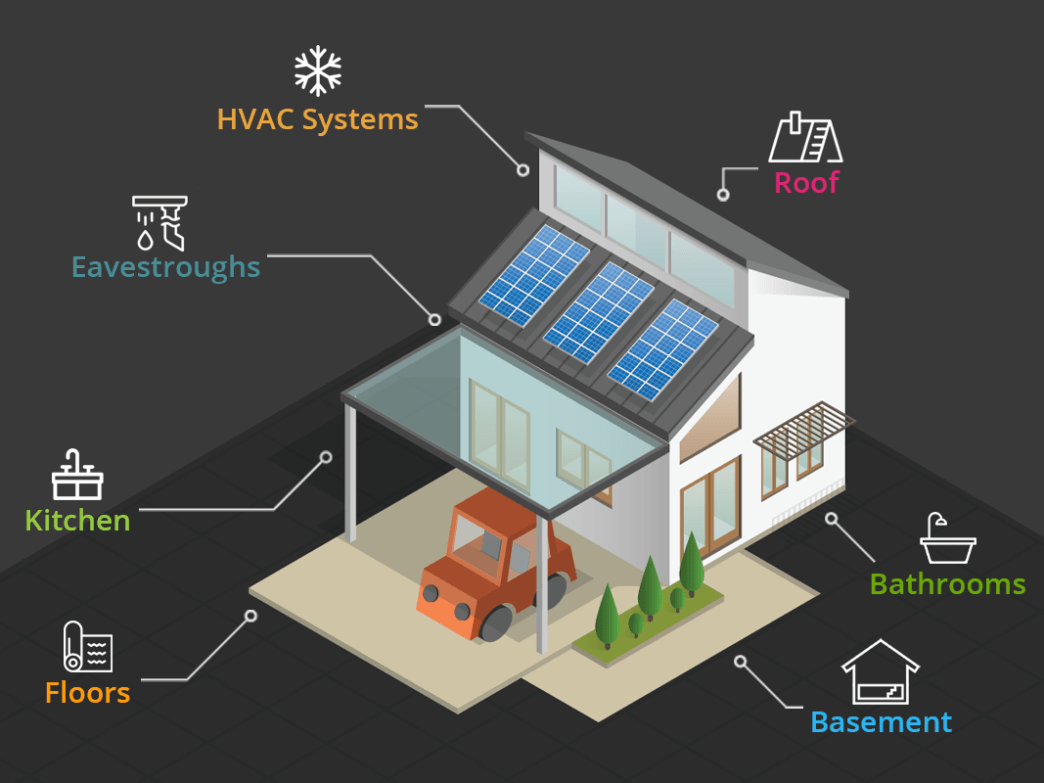

Eight house hunting tips that should know about. It’s no secret that buying a house in Toronto is an investment. In the midst of a global pandemic, the market has skyrocketed, with the average home in the city selling at a record-breaking $1 million. But not every home in the market actually lives up to its price tag. If you’re house hunting, these tips will help you make sure you get your money’s worth. Think beyond the list price Custom built luxury house in the suburbs of Toronto, Canada. The cost of a house doesn’t start and end with the list price. Things like renovations, remodelling, and repairs can quickly add to your expenses. Talk to your Toronto mortgage broker about whether it makes sense to make a sizeable down payment to secure great mortgage rates and conditions or pay down less upfront and pour the extra cash into upgrades. Start from the very top A beautiful home with a bad roof is a disaster waiting to happen. Before you put in a bid on a home, find out when the roof was installed and if it was recently damaged or repaired. Also, be sure to request a roof certificate and an inspection by a roofing specialist trained to spot the less visible issues average inspectors might miss. Don’t pour money down the gutter Eavestroughs might seem like a minor detail, but blocked or damaged troughs can cause major problems like flooded roofs, attics, walls and basements. It’s well worth the upfront investment to install gutter protection to avoid the headache and expense of repairing water damage down the road. Avoid waterlogged basements Basements give you a fantastic opportunity to expand your living space when properly maintained. Basement waterproofing is one of the most important things you should have done for your new home to avoid the costs that come with flooding damage. When viewing a home, check basement floors and walls for the telltale signs of leaks–cracks, stains, mould or puddles–to avoid shelling out thousands on foundation repair or mould removal. Don’t skimp on the duct inspection If you want your home to be cozy in the winter, cool in the summer and safe all year round, a well-maintained HVAC system is a must. Ensure any home on your shortlist has had the ducts properly inspected to avoid carbon monoxide leaks that put your family at risk or inefficient furnaces and A/C systems that will raise your hydro bills. Choose quality over style in the kitchen dNovo Group - Renovated Kitchen Kitchens are one of the go-to spaces sellers renovate to add value to their homes but remember that your kitchen needs to be just as functional as it is beautiful. The costs associated with a kitchen renovation can add up quickly, and this is why it’s important that the initial state of the kitchen is not overlooked. Pay special attention to the quality of the appliances, whether there is adequate storage and cabinet space and a smart layout when you are viewing the house. Make sure to have the plumbing and electrical inspected as well to ensure that they are also in great condition. Be wary of damp bathrooms dNovo Group - Renovated Bathroom Just like kitchens, bathrooms often get a facelift before houses hit the market. But this is another space where quality should outweigh aesthetics every time. The bathroom renovation in your dream home should cover proper ventilation to avoid grout and mould developing on the walls and ceilings. You should also check for leaky pipes and fixtures that lead to water damage. Take a hard look at hardwood flooring If a house you’re considering has hardwood flooring, there are a few things you should check for before you buy. Watch out for dark stains or sunken planks that usually indicate moisture and mould issues. Giving special attention to flooring in basements, crawl spaces, closets and under carpets and rugs can ensure you catch any damage that is often hidden in those spaces. If in doubt, ask the homeowner or realtor when the flooring was installed or last repaired. Keeping these details in mind as you navigate the housing market in search of the home will leave for the best home buying experience you can give yourself. Invest in a property that fits your needs and comes with safe conditions and no surprises. Article by: Toronto Life

Is it possible to own land on Mars? On Nov. 26, 2018, NASA’s InSight lander touched down on Mars, becoming the eighth space-exploring robot to visit the Red Planet. For adventurous humans inspired to eventually follow in the footsteps of this spacecraft, possibly terraforming Mars or owning land there may seem like the next best thing. A handful of companies, such as Buy Mars and Lunar Embassy, sell ads on Facebook and elsewhere claiming they “possess a legal trademark and copyright for the sale of extraterrestrial property” or are the “only recognized world authority” for the sale of lunar and planetary real estate. Deeds sell between $30 and $500. While it may be true that colonizing Mars is on the horizon, can anyone really own property on Mars? How Valid Is a Mars Land Deed? Like all real estate transactions, it comes down to the law. The foundational law for space was drafted 50 years ago, when space exploration was still in its infancy. In 1967, the United States, the then–Soviet Union and the United Kingdom wrote the “Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies.” Nicknamed the “Outer Space Treaty,” the document established guidelines to ensure equal and peaceful access to space. More than 100 nations signed it. It accounts for real estate in space, among other things. Article II of the Outer Space Treaty states, “Outer space, including the moon and other celestial bodies, is not subject to national appropriation by claim of sovereignty, by means of use or occupation, or by any other means.” In short, nobody can claim ownership of Mars or land on Mars, or do so with any other celestial body. But the treaty was made to be modified as society advanced. In 2015, the United States Congress passed the Spurring Private Aerospace Competitiveness and Entrepreneurship Act of 2015, or SPACE Act, which allows U.S. citizens to “possess, own, transport, use and sell” materials extracted from celestial bodies, reported Nature. The new law accounts for the growing interest in mining asteroids, the moon or other celestial bodies for minerals or other resources. Private companies will be able to set up shop on Mars, mine it and lay claim to those resources, but won’t be able to own the land. For those who really want a Mars land deed with their name on it, there’s nothing wrong with buying one. It’s a novelty item that might make a nice gift for the person who has everything. But it’s just for fun. The document won’t be recognized by any government authority as legitimate or legally binding. A Mars Colony Is Coming Even as the Mars InSight lander begins to gather scientific data from the Red Planet to better inform the potential for human survival there, Earthlings are making plans to colonize Mars. In December 2017, President Donald Trump signed the Space Policy Directive-1, which refocused America’s space program on human exploration. The plan involves returning humans to the moon, establishing a means for traveling to Mars by the 2030s and eventually expanding human presence across the solar system later in the century. Getting beyond the moon will require advanced rocket propulsion to speed astronauts to their destination. Northrop Grumman Innovation Systems is building the boosters for NASA’s Space Launch System rocket, designed to take humans beyond Earth orbit. In 2020, the rockets will launch an uncrewed Orion spacecraft to the lunar vicinity as part of Exploration Mission-1. The mission will be step one in a series of increasingly complex missions that will work like stepping stones to lead humans into deep space. Others are shooting for Mars, too. Mars One, a venture launched by Dutch entrepreneur Bas Lansdorp, says they aim to have humans on Mars by 2031. When Will Humans Begin Terraforming Mars? A hundred years from now, humans may be thriving on Mars. But they’ll likely be conducting their lives under the confines of a transparent dome akin to a large terrarium. Climate, temperature and atmosphere will be controlled, and humans will be able to grow plants for food. Terraforming Mars — that is, manipulating the atmosphere to create an Earth-like, habitable environment — is simply not possible using any of the technology available to humans, according to NASA. Scientists have proposed large-scale geo-engineering projects, such as releasing carbon dioxide trapped in the Martian soil to create a thicker atmosphere that warms the planet. But recent studies have shown that there isn’t enough CO2 in the soil. The atmospheric pressure on Mars is also less than 1 percent of that on Earth. If, somehow, scientists could figure out how to warm the skies and get them to rain, the water would evaporate quickly. For now, humans will have to be satisfied with standing on planet Earth and gazing up at the red dot in the sky. Over the ages, that dot has inspired humanity to imagine an existence beyond the heavens. The potential for extraterrestrial life, colonization and terraformation calls to civilization and soon, we will make our way into space. We’ve taken the first steps by sending machines ahead of us. In fact, Mars is the only planet in the solar system inhabited by robots. Perhaps, one day soon, we will join them. Article by: AMANDA MAXWELL

What is an Assignment sale? An assignment is essentially a sale of a contract or right to acquire property. An assignment is a transaction whereby the original purchaser (the "Assignor") of a property sells, and thereby transfers, their interest and obligations under the original contract to a new purchaser (the "Assignee"). The Assignee will generally assume all of the Assignor's duties and obligations under the original Agreement of Purchase and Sale. These rights and obligations are stated in the original Agreement of Purchase and Sale and include terms such as interest payments, taxes and maintenance fees during interim occupancy. Upon completion, the Assignee is granted the title to the real property and will incur all final closing costs. To make it simple an "assignment" is the sale of a contract to purchase a pre-construction condominium suite. It usually means that the building has not been registered yet, so no one can take ownership of the unit itself. Only the original contract can be sold. Once the condo has been registered, you can transfer the ownership title. Until then, it’s just the sale of a contract. There are many advantages to these kinds of sales for both the buyer and seller. What are the reasons why somebody would do an assignment sale? There are many reasons why someone would want to sell the rights to their condo before it’s been built. A typical scenario would be a buyer may have bought a condo that’s closing in 2 years, but has discovered that he or she needs to relocate to a different province. This buyer may need to sell their agreement to afford a property in their new city. In this case it allows the original buyer to assign the contract onto another party without incurring financial penalties. For Example: Tom is the Assignor: An Assignor is the original buyer of the unit from the Builder/Developer. Kyle is the Assignee: An Assignee is the buyer of the Agreement of Purchase and Sale from the Assignor. Here's an example of "Tom the Assignor" and "Kyle the Assignee" Tom the Assignor buys a newly developed condo from Toronto Builder & Company for a purchase price of $600,000 with a possession date of 2022 Tom's downpayment is 20% = $120,000 Mortgage amount on closing $480,000 A year and a half later Tom discovers that he needs to move to a different province due to family. However because Tom's condo is not built yet and all of his funds are tied up in his newly purchased condo Tom decided to hire a realtor to help him assign his contract with a new prospect. Tom's realtor finds a prospect named Kyle that is willing to purchase Tom's agreement for $700,000. The newly assigned contract will cost Kyle $220,000. The intial downpayment of $120,000 plus $100,000. (The difference between the original purchase price $600,000 and the newly assigned purchase price $700,000) The total funds required on closing will be $480,000 Before the condo is registered Kyle will move in the during the interim occupancy period and pay the interim occupancy fees required by builder "Toronto Builder & Company" Once the condo building becomes registered- usually less then one year. Kyle will become the registered owner on title. There are many advantages to assignment sales from the both buyer and seller. It allows the seller to legally assign his or hers contract prior to closing and the opportunity to gain equity and the buyer to purchase a suite in there desired location which has been possibly sold out while avoiding excessive competition and often means you pay much less than you would for a resale unit. The above is a simple example of an assignment and does not factor in closing costs, mortgage regulations, taxes, reimbursement of the seller’s deposits and more must be taken into consideration.